Creating a budget is a fundamental step in achieving financial stability and understanding one’s financial landscape. The first step in this process involves gathering all financial information, including income sources, fixed expenses such as rent or mortgage payments, variable expenses like groceries and entertainment, and any debt obligations. This comprehensive overview allows individuals to see where their money is coming from and where it is going.

A common method for organizing this information is the 50/30/20 rule, which suggests allocating 50% of income to needs, 30% to wants, and 20% to savings and debt repayment. This framework provides a clear structure for individuals to follow, ensuring that essential expenses are covered while still allowing for discretionary spending and savings. Once the budget is established, the next challenge is sticking to it.

This requires discipline and regular monitoring of spending habits. One effective strategy is to use budgeting apps or spreadsheets that track expenses in real-time, providing immediate feedback on spending patterns. Additionally, setting up automatic transfers to savings accounts can help ensure that savings goals are met without the temptation to spend that money elsewhere.

Regularly reviewing the budget—monthly or quarterly—can also help identify areas where adjustments may be necessary. For instance, if an individual consistently overspends in a particular category, it may be worth reassessing that budget line or finding ways to cut back on discretionary spending.

Key Takeaways

- Budgeting Basics: Creating a budget helps track expenses and prioritize spending.

- Building and Maintaining Good Credit: Pay bills on time and keep credit card balances low to improve credit score.

- Saving for the Future: Start an emergency fund and contribute to retirement accounts regularly.

- Managing Debt: Pay more than the minimum on student loans and credit card debt to reduce interest.

- Investing 101: Diversify investments and seek professional advice to build wealth.

Building and Maintaining Good Credit: Tips for Establishing and Improving Credit Score

Establishing good credit is crucial for financial health, as it affects everything from loan approvals to interest rates. The first step in building credit is obtaining a credit card or a small loan, ideally one that reports to the major credit bureaus. For those new to credit, secured credit cards can be an excellent option; they require a cash deposit that serves as collateral and helps mitigate risk for lenders.

Using this card responsibly—keeping balances low and making timely payments—can help establish a positive credit history. It’s also beneficial to become an authorized user on a responsible person’s credit card, as this can help build credit without the risks associated with managing a card independently. Maintaining good credit requires ongoing diligence.

One of the most significant factors affecting credit scores is payment history, which accounts for 35% of the FICO score calculation. Therefore, setting up reminders or automatic payments can help ensure bills are paid on time. Additionally, keeping credit utilization below 30% of available credit is essential; high utilization can signal financial distress to lenders.

Regularly checking credit reports for errors is another critical practice, as inaccuracies can negatively impact scores. Individuals are entitled to one free credit report per year from each of the three major bureaus—Equifax, Experian, and TransUnion—allowing them to monitor their credit health effectively.

Saving for the Future: Strategies for Building an Emergency Fund and Saving for Retirement

Building an emergency fund is a cornerstone of financial security, providing a safety net for unexpected expenses such as medical emergencies or job loss. Financial experts recommend saving three to six months’ worth of living expenses in an easily accessible account. To achieve this goal, individuals can start by setting aside a small percentage of each paycheck into a dedicated savings account.

Automating these transfers can make saving easier and more consistent. Additionally, individuals can look for ways to cut back on non-essential expenses or find side gigs to boost their income, funneling any extra funds directly into their emergency savings. Retirement savings is another critical aspect of financial planning that should not be overlooked.

Starting early can significantly impact the amount accumulated over time due to the power of compound interest. Many employers offer retirement plans such as 401(k)s with matching contributions; taking full advantage of these matches is essentially free money that can accelerate retirement savings. For those without access to employer-sponsored plans, Individual Retirement Accounts (IRAs) provide tax-advantaged options for saving.

It’s essential to regularly review retirement goals and adjust contributions as income increases or financial situations change, ensuring that individuals remain on track to meet their long-term objectives.

Managing Debt: Tips for Paying Off Student Loans and Credit Card Debt

| Debt Type | Interest Rate | Minimum Payment | Outstanding Balance |

|---|---|---|---|

| Student Loans | 5% | 200 | 20,000 |

| Credit Card Debt | 18% | 100 | 5,000 |

Managing debt effectively is crucial for maintaining financial health and achieving long-term goals. Student loans often represent a significant burden for graduates, but there are strategies available to ease this financial strain. One effective approach is the income-driven repayment plan, which adjusts monthly payments based on income and family size, making them more manageable.

Additionally, refinancing student loans can lead to lower interest rates, reducing overall repayment costs. It’s also wise to prioritize high-interest loans first—often referred to as the avalanche method—paying more than the minimum on these debts while maintaining minimum payments on others. Credit card debt can be particularly challenging due to high-interest rates that can quickly accumulate if balances are not paid off promptly.

One effective strategy for tackling credit card debt is the snowball method, where individuals focus on paying off the smallest debts first while making minimum payments on larger debts. This approach can provide psychological motivation as debts are eliminated one by one. Another important tactic is to avoid accumulating new debt while paying off existing balances; this may involve cutting back on discretionary spending or using cash instead of credit cards for purchases.

Seeking professional advice from a financial counselor can also provide personalized strategies tailored to individual circumstances.

Investing 101: Introduction to Investing and Building Wealth

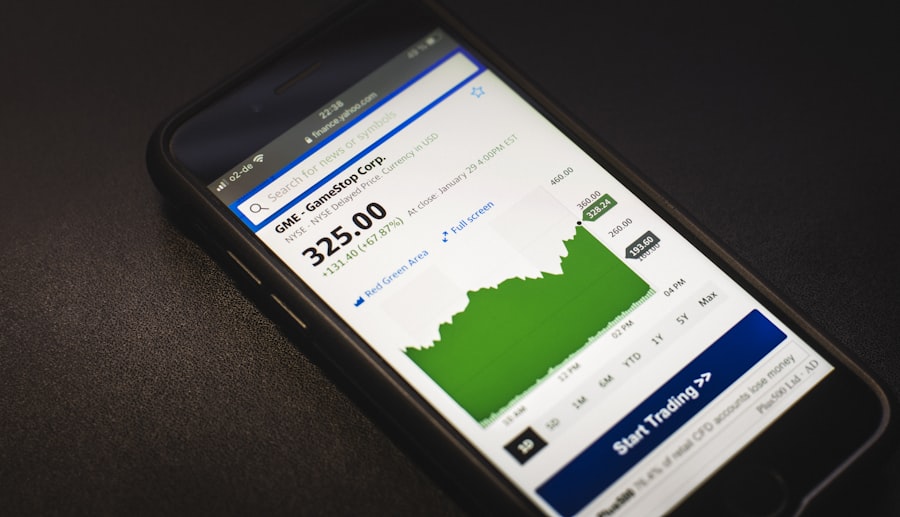

Investing is a powerful tool for building wealth over time, yet many individuals feel intimidated by the prospect of entering the investment world. The first step in investing is understanding the different types of investment vehicles available, such as stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Stocks represent ownership in a company and have the potential for high returns but come with higher risk.

Bonds are generally considered safer investments that provide fixed interest payments over time. Mutual funds and ETFs allow investors to diversify their portfolios by pooling money with other investors to purchase a variety of assets. A critical aspect of investing is developing a strategy that aligns with one’s financial goals and risk tolerance.

For instance, younger investors may choose a more aggressive portfolio with a higher percentage of stocks since they have time to recover from market fluctuations. Conversely, those nearing retirement may prefer a more conservative approach with a focus on preserving capital through bonds and stable investments. Regularly contributing to investment accounts—such as through employer-sponsored retirement plans or individual brokerage accounts—can help build wealth over time through dollar-cost averaging, which reduces the impact of market volatility by spreading out investments over time.

Financial Goals: Setting and Achieving Short and Long-Term Financial Goals

Setting clear financial goals is essential for guiding financial decisions and maintaining motivation throughout the journey toward financial stability. Short-term goals might include saving for a vacation or paying off a specific debt within a year, while long-term goals could involve saving for retirement or purchasing a home within five to ten years. The SMART criteria—Specific, Measurable, Achievable, Relevant, Time-bound—can be an effective framework for establishing these goals.

For example, instead of vaguely stating “I want to save money,” an individual might set a goal like “I will save $5,000 for a down payment on a car within 18 months.” Achieving these goals requires consistent effort and regular progress assessments. Creating a detailed action plan that outlines specific steps toward each goal can help maintain focus and accountability. For instance, if the goal is to save $5,000 in 18 months, breaking it down into monthly savings targets makes it more manageable—approximately $278 per month.

Utilizing budgeting tools can assist in tracking progress toward these goals while also identifying areas where adjustments may be necessary if challenges arise. Celebrating milestones along the way can also provide motivation and reinforce positive financial behaviors.

Understanding Taxes: Tips for Filing Taxes and Maximizing Tax Benefits

Navigating the tax landscape can be daunting for many individuals; however, understanding tax obligations and benefits is crucial for effective financial management. The first step in this process is familiarizing oneself with different tax forms and deadlines relevant to personal circumstances—such as W-2s for employees or 1099s for freelancers—and ensuring all necessary documentation is organized before tax season arrives. Utilizing tax preparation software or consulting with a tax professional can streamline the filing process and help identify potential deductions or credits that may apply.

Maximizing tax benefits involves taking advantage of available deductions and credits that can reduce taxable income or provide direct reductions in tax liability. Common deductions include mortgage interest, student loan interest, and contributions to retirement accounts like IRAs or 401(k)s. Tax credits such as the Earned Income Tax Credit (EITC) or Child Tax Credit can significantly lower tax bills for eligible individuals or families.

Additionally, keeping thorough records throughout the year—such as receipts for deductible expenses—can simplify the filing process and ensure that no potential savings are overlooked.

Financial Independence: Steps to Achieving Financial Independence and Freedom

Achieving financial independence represents a significant milestone in personal finance—a state where one’s investments generate enough income to cover living expenses without relying on traditional employment. The journey toward financial independence often begins with establishing clear financial goals and creating a comprehensive plan that includes budgeting, saving, investing, and managing debt effectively. Many individuals adopt the FIRE (Financial Independence Retire Early) movement principles, which emphasize aggressive saving and investing strategies aimed at reaching financial independence at an earlier age than traditional retirement norms suggest.

To work toward financial independence, individuals should focus on increasing their income through career advancement or side hustles while simultaneously minimizing expenses through frugal living practices. Investing wisely in diversified portfolios can accelerate wealth accumulation over time; this includes not only traditional stocks and bonds but also real estate or alternative investments that align with personal risk tolerance and goals. Regularly reassessing financial plans and adjusting strategies based on changing circumstances ensures continued progress toward achieving true financial freedom—a state where choices are driven by personal desires rather than financial constraints.

FAQs

What is personal finance?

Personal finance refers to the management of an individual’s financial resources, including budgeting, saving, investing, and managing debt.

Why is personal finance important for millennials?

Personal finance is important for millennials because it helps them to achieve financial stability, plan for the future, and make informed decisions about their money.

What are some common financial challenges faced by millennials?

Some common financial challenges faced by millennials include student loan debt, high housing costs, stagnant wages, and the pressure to keep up with social media-driven lifestyles.

What are some key personal finance tips for millennials?

Some key personal finance tips for millennials include creating a budget, building an emergency fund, paying off high-interest debt, investing for the future, and seeking out financial education and advice.

How can millennials start investing for their future?

Millennials can start investing for their future by opening a retirement account, such as a 401(k) or IRA, and investing in low-cost index funds or exchange-traded funds (ETFs) to build a diversified investment portfolio.

What are some resources available to help millennials improve their personal finance skills?

There are many resources available to help millennials improve their personal finance skills, including online budgeting tools, personal finance apps, financial literacy courses, and books on personal finance and investing.